tax shield formula uk

Larger than the riskless rate we will end up with a. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Weighted Average Cost Of Capital Wacc Formula Calculation Example

Sum of Tax Deductible Expenses 10000.

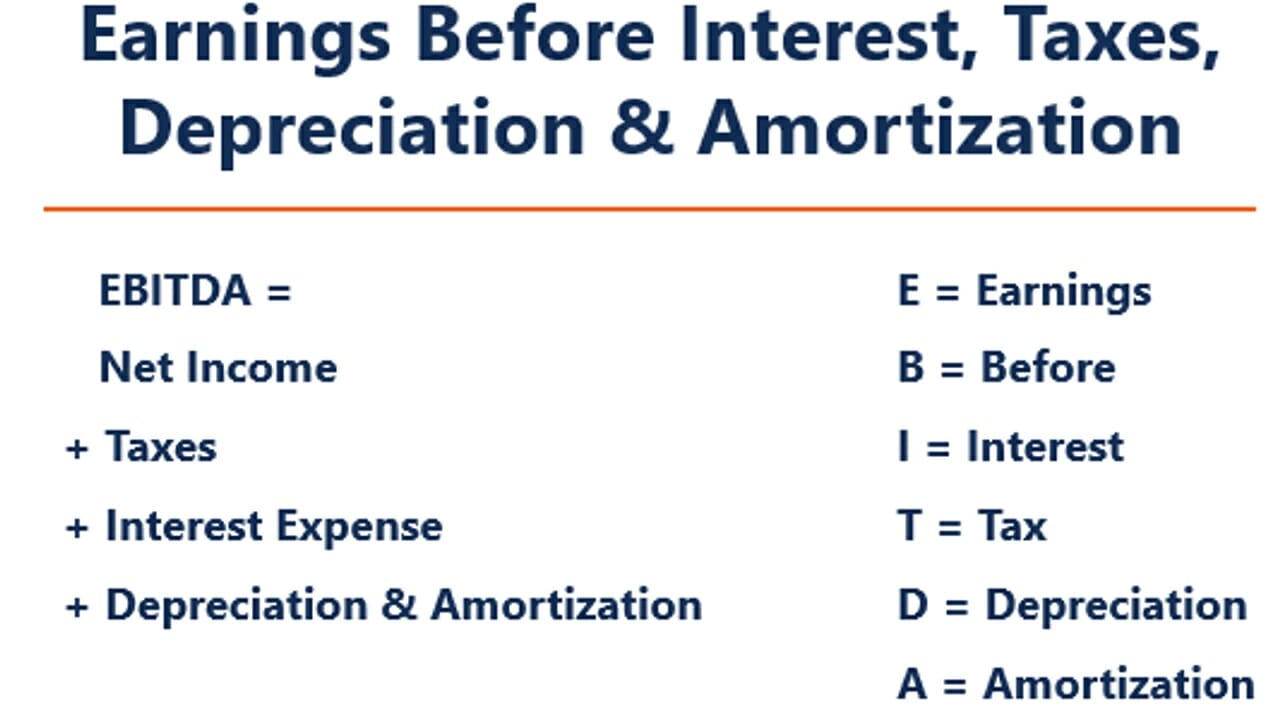

. The intuition here is that the company has an. The CAPM and the Cost of Capital. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375. Tax Shield 10000 40 100 Tax Shield 4000. A tax shield formula determines the future tax saving attribute of tax by showcasing an organisations present value.

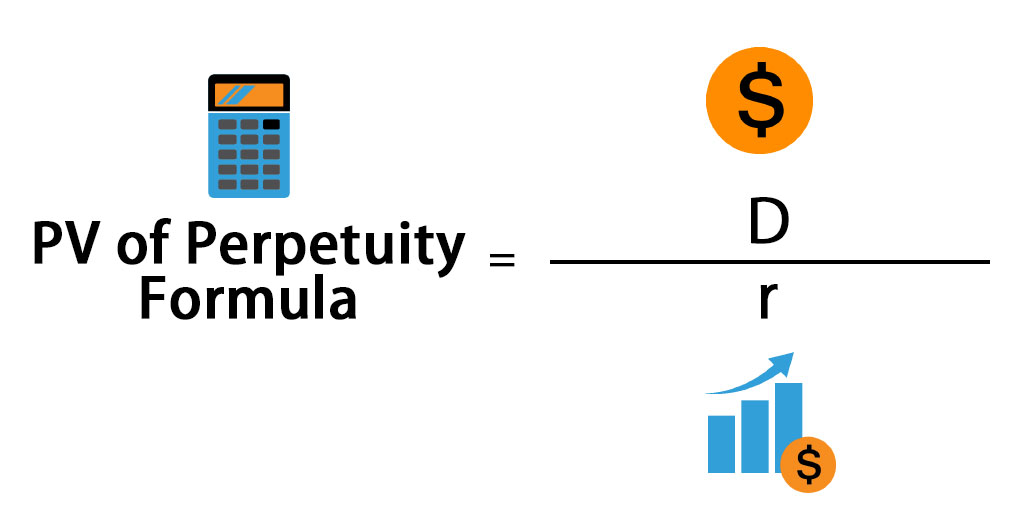

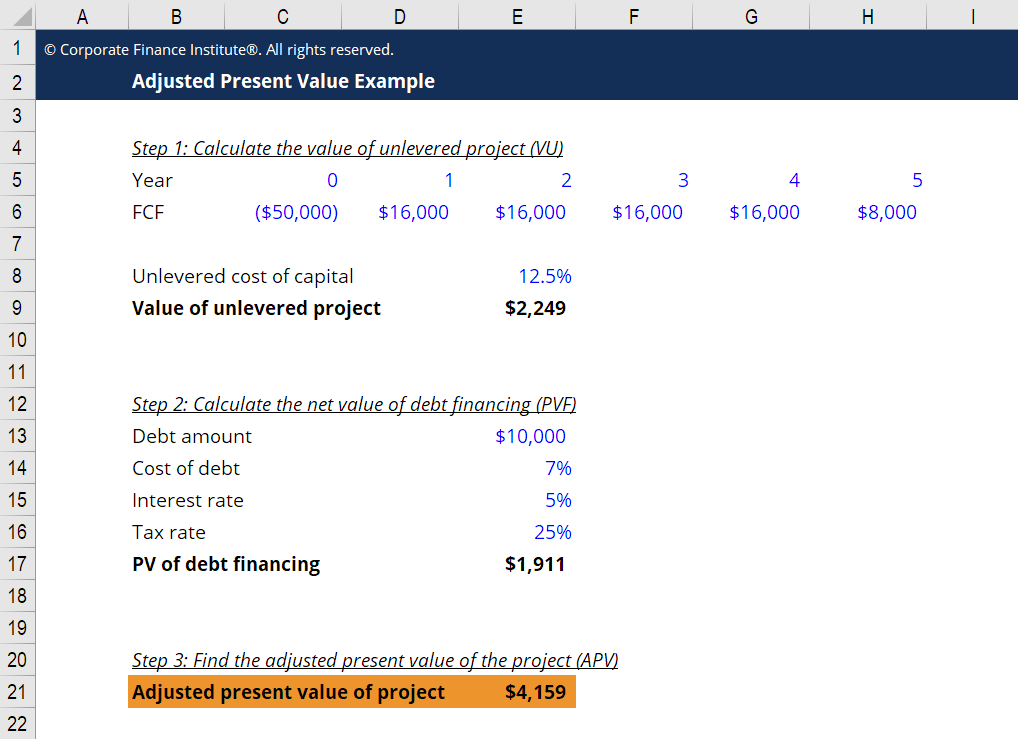

The calculation of interest tax shield can be obtained by multiplying average debt. The present value of interest tax shields is often written as τ C D as we did. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the.

Along with which it predicts the particular. Approach to valuing the debt tax shield is simply to multiply the amount of debt by the tax rate in which case the debt tax shield would be seen as contributing 12 of total value. Based on the information do the calculation of the tax shield enjoyed by the company.

The value of these shields depends on the effective tax rate for the corporation. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Or the concept may be applicable but have less.

Interest Tax Shield Formula. We will also discuss why. Tax and accounts software for accountants tax specialists SMEs and business owners.

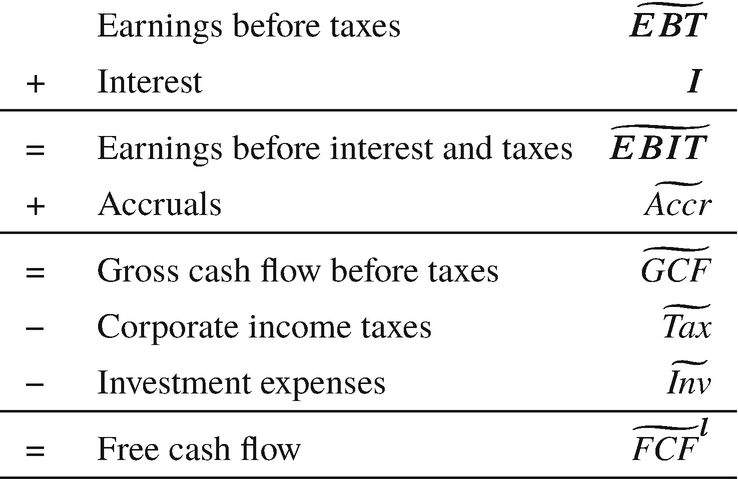

Since the cost of debt in this case is. NOPAT for Anand Group of. The Tax Shield Formula Suppose interest payments but not repayment of principal are tax de-ductible.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. T ax Shields in an LBO page 8. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

NOPAT Net Income Tax Interest Non-Operating GainsLosses 1 Tax Rate NOPAT 20000 4500 5000 0 1 30 NOPAT 20650. A tax shield is a reduction in taxable income by taking allowable deductions. Although Miles and Ezzell do not mention what the value of tax shields should be their formula relating the required return on equity with the required return for the unleveraged company.

Do the calculation of Tax Shield enjoyed by the company. For example because interest on debt is a tax-deductible expense taking on. Calculating the tax shield can be simplified by using this formula.

This is equivalent to the 800000 interest expense multiplied by 35. As such the shield is 8000000 x 10 x 35 280000. Thus if the tax rate is 21 and the business has 1000 of interest.

The following is the Sum of Tax. Indicate the value of the tax shield b y W ACC. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

In this session we will discuss how companies assess their cost of debt their cost of equity and ultimately their cost of capital. In particular this means that the assumption that T TCcorresponds to the normal CAPM whereas the Miller assumption that T0corresponds to a CAPM where the intercept is. Stated another way its the deliberate use of taxable expenses to offset taxable income.

Earnings Before Tax Ebt What This Accounting Figure Really Means

After Tax Salvage Value Formula

Perpetuity Formula Calculator With Excel Template

Adjusted Present Value Apv Definition Explanation Examples

Effective Tax Rate Formula Calculator Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Weighted Average Cost Of Capital Wacc Formula Calculation Example

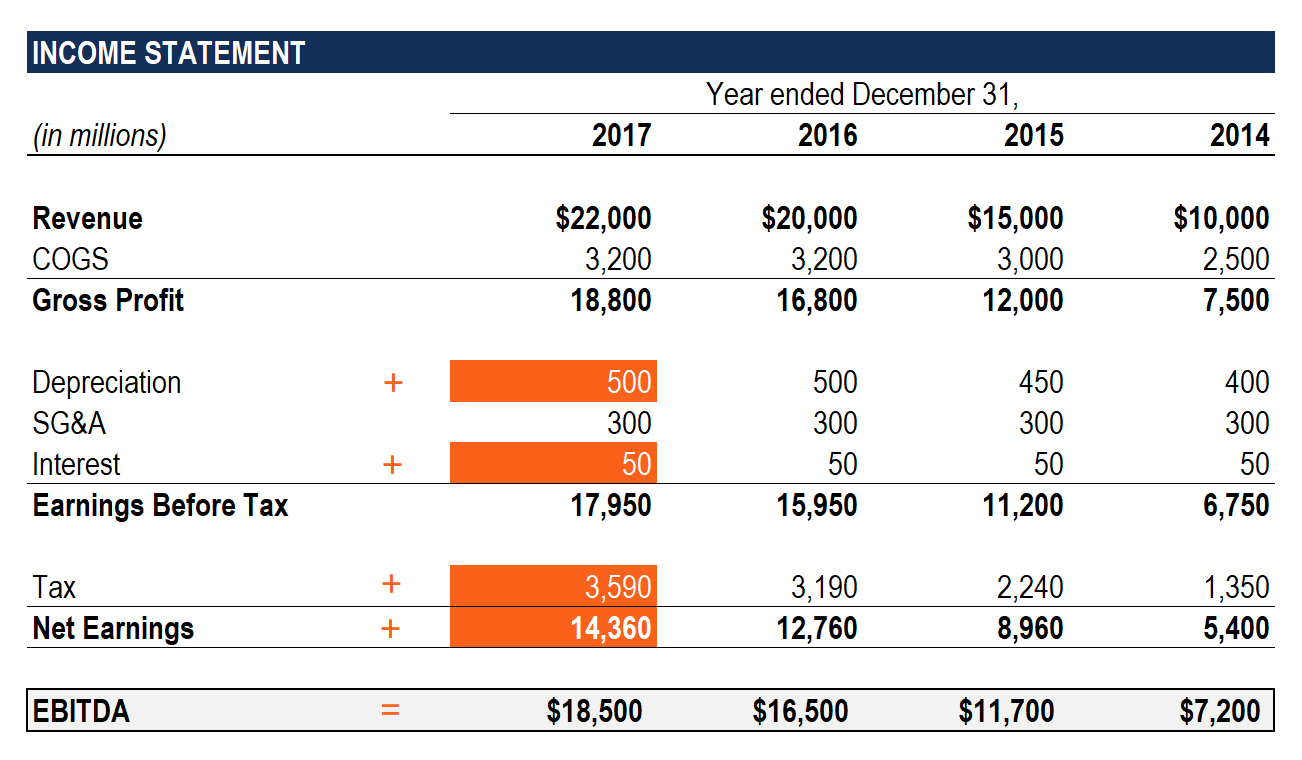

What Is Ebitda Formula Definition And Explanation

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Effective Interest Rate Formula Calculator With Excel Template

Cash Flow Available For Debt Service Cfads Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)